Copyright 2012 Peter J. May JD, LLM, CFP

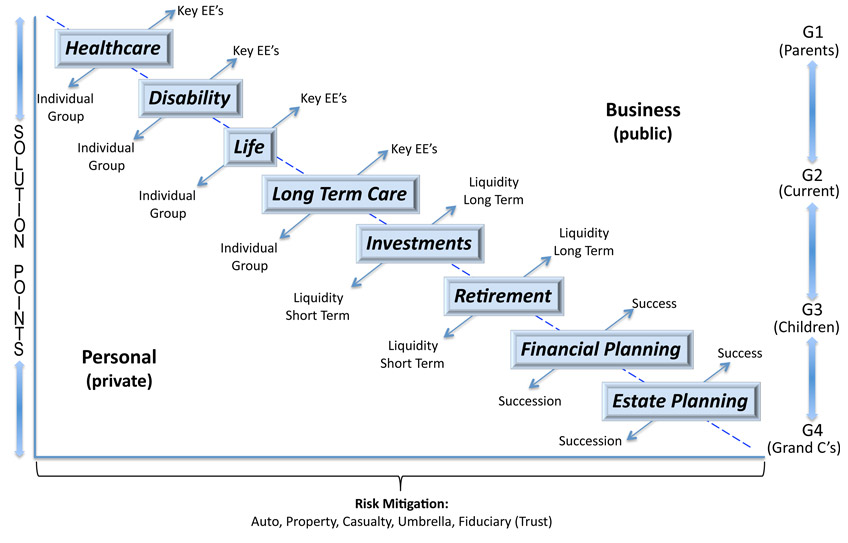

The Personal Wealth Spectrum is the framework that guides our interactions and engagements with clients. The hallmark of this approach is a line of sight across all of the components (blue boxes) from Healthcare to Long Term Care through Financial and Estate Planning.

We are passionate in conveying the fact these eight components are very closely interrelated and impactful to one another. We believe that it is our obligation to educate and demonstrate to clients how they interrelate and how a failure attributable to a slight nuance in one component can wreak serious havoc in the other components.

The challenge that we often see is clients historically have solved for one or two components at a time, within a “silo” approach. Over time they may have implemented viable solutions separately within each of the silos. However, the net overall effect on the bigger Personal Wealth Spectrum can be less than optimal.

Our goal is to deliver optimized solutions by leveraging Subject Matter Experts who posses deep skills and expertise within each of the components. We take the time to understand the “big picture”, even when the scope of our work may be limited to one component.

Another key concept is the multi-generational overlay. Clients are considered “Generation 2” (G2) for the purposes of our framework. Our process lends itself to understanding G1 through G4 in the generational tree as it relates to our clients’ goals and objectives within their individual Personal Wealth Spectrum.

We work with clients in both their business (public) side and the personal (private) side. The objective is to ensure the success and the succession of our clients’ businesses and their wealth planning in both the short and long term.

Simply put, our activities and processes focus around the concepts of risk mitigation and optimizing solutions across the entire Personal Wealth Spectrum.